StonebridgeFOCUS | The American Spendthrift Part II

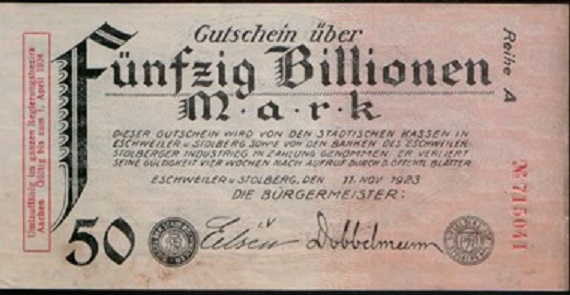

In the early 1900s, the Weimer Republic (Germany) spent $33 billion to fund their war efforts in WW1, when one US dollar could be exchanged for about 5 marks (their currency). As part of the fallout from losing the war, The Treaty of Versailles demanded reparations from Germany which only accelerated the devaluation of the mark. By 1919, you would need 48 marks to buy one US dollar. In early 1921, you would need 90 marks to buy one dollar. And by the end of the year, you would need 330. Downward spiral.

In order to satisfy the reparation payments, Germany started the mass printing of money, which started a period of hyperinflation. By the fall of 1922, the German mark was, for all intents and purposes, worthless. A loaf of bread that cost 160 marks in 1922 cost 200 billion marks by the end of 1923. And a single dollar was worth 4.2 trillion German marks. Yes, you read that right, four trillion marks for one US dollar. Just devastating.

More recently, Venezuela has been dealing with hyperinflation over the last decade. In 2012, one US dollar was worth 10 Venezuelan bolívars. Heavy money printing, deficit spending, and political turmoil led the South American country into a vicious downward spiral. By 2015, one US dollar was worth 900 bolívars.

As of December 2020, a cup of coffee that we could buy at Starbucks for $1.85 cost over 2.2 million bolívars in Venezuela.

The hyperinflation experienced by Germany in the 1920s and by Venezuela over the last several years are some of the more extreme examples, but they speak to its debilitating effects. In both instances, deficit spending was a primary driver.

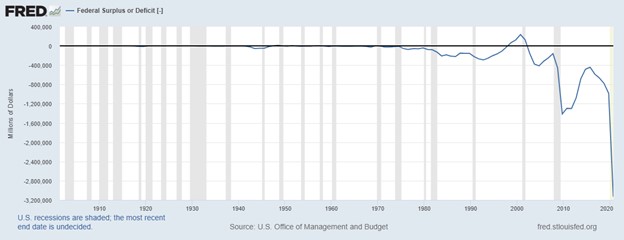

In Part I of our two-part series, we presented our thoughts on deficit spending and how it compares to historical norms. If you missed Part I of our series, you can find it here.

We may not always know the root cause, but inflation exists and isn’t something to shrug off. We often talk about three things that eat away at wealth over time: fees, taxes, and inflation. The first two are relatively immediate. You pay taxes and fees throughout the year. You feel those when they are due. But inflation is typically a slow process. No one is sending you a bill or an invoice for inflation. It is financial atrophy. It is a risk that is hard to see because it doesn’t come in the form of a car crash, but a slow and steady withering of your purchasing power. It is bumper-to-bumper traffic, and before you know it, you’re stuck on the 101 for hours.

Probably the only rival to the skyrocketing cost of college is the exponentially increasing cost of healthcare. Fortunately, TVs are cheaper than ever. Unfortunately, a 75” Samsung can’t give you an x-ray or teach you how to practice law. But that’s how inflation works. Some things get cheaper, while others get more expensive. We like to think that inflation is simply a sign of scarcity, where we simply don’t have enough of something. But it’s not like we have a shortage of colleges or hospitals. It’s all a bit more complicated.

It’s clear that deficit spending can result in an inflationary environment. Inflation in economics bears a stunning resemblance to inflammation in medicine. It’s not an action or something directly in control of the physician. It’s a side-effect, or reaction of the body fighting against a threat. Inflation is merely a side effect, and taxes have historically been used as the remedy.

We’ve all probably heard the quote from Ben Franklin that “in this world, nothing is certain but death and taxes.” It makes sense that people get worked up about it. You have the IRS, FICA, and FUTA taking cuts right out of your paycheck. Then there is AMT based on AGI that affects your ISOs. It’s complicated, confusing, and results in you having less money.

The Biden Administration has shown their hand regarding corporate tax rate changes (boosting them to 28% from 21% under the Tax Cuts & Jobs Act) designed to pay for infrastructure spending. As for individuals, those earning $400,000 or more seem to be the primary targets for changes in personal taxes. The highest federal rate will likely revert to 39.6%, plus the Medicare surtax among other changes. But first, allow me to digress.

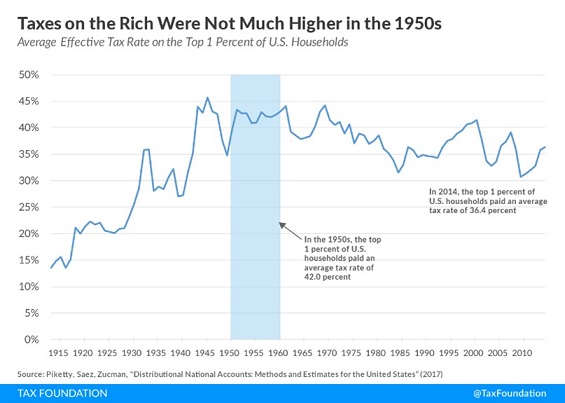

For those who would say that “39.6% is nothing, tax rates used to be much higher than that,” I would say “yes, but almost no one paid it.” In 1945, at the conclusion of the most expensive war in history (more than all wars combined), the highest tax rate in the US was 94% for incomes over $200,000 (or about $2.5m in today’s dollars) and only about 10,000 households paid it. More accurate tax rates, or effective tax rates, are largely unchanged since the 1940s for the Top 1% of households in the US. End digression.

The Biden Administration is also expected to increase the income subject to Social Security taxes. Currently, the 12.4% (split between employee and employer) tax is levied on income up to $137,700 for 2020. It is expected that President Biden will push for an increase from $137,700 to $400,000.

Perhaps the most contentious proposal is to remove the step-up in basis, a popular estate planning technique, as well as make all capital gains taxed at ordinary income rates (plus a surtax for Affordable Care Act subsidies) for those earning more than $1,000,000. Then there is the Wall Street Tax Act, which proposes a tax on the sale of every stock, bond, and derivative.

To be clear, no one knows what the final tax bill will look like. Any proposal from the President will need to go through Congress where anything can happen. Nevertheless, taxes are part of our life. They will go up. They will go down. Our elected officials will find more things to tax. Some of them good. Some of them silly. This is the chaotic, counterintuitive, and irrational world we live in.

The one thing that we can count on is that taxes will change, in part due to the effects of inflation.

So does deficit spending and increased debt lead to inflation and higher taxes? Historically, yes. Should we be worried? Probably not. Deficits have exploded since 2008 and broad-based inflation has barely registered 2%. It stands to reason that the relationship that once existed, no longer does, or at least not in the same way.

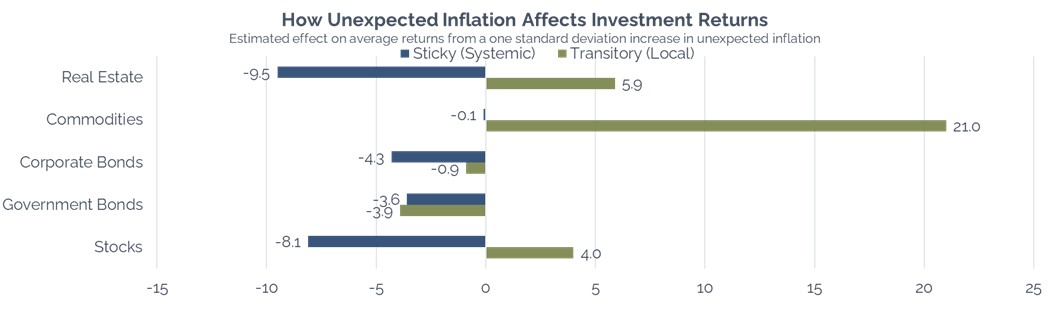

Instead of focusing on taxes and deficit spending, we need to reconsider our view of how inflation works and be more intentional on how we address it.

It’s fair to look at those two areas and conclude that government funding is the primary cause for why inflation for healthcare and education is so high. It could be true. But it ignores nuance and all the other factors that can play into the question: “How did we get here?”

The Apollo 8 spacecraft, which was the first to orbit the moon, was built with millions of systems and parts. Even if each were 99.9% effective, there would still be thousands of defects and errors. The economy is like Apollo 8 but instead of different parts and systems that do “A” or “B” you replace them with people who are driven by unpredictable emotions. There are millions of variables that play into how inflation influences our lives.

A great real-time example is the increase in used car prices. New auto production has been dialed back based on chip shortages needed for onboard computers, which has pushed used car sales up to record levels. The culprit? COVID-19 shutting down production and disrupting supply chains. Another blow are rental car companies getting back into the game as travel starts to pick up. Not deficit spending but external factors and human behavior.

It feels unnatural to look at how the government spends, and not think we’re on a one-way ticket to bankruptcy. But governments don’t play the same game as the rest of us. There are different rules and dynamics that if applied in our own lives would be disastrous.

The takeaway is that there will always be some actions taken by our elected officials that give us pause or reason for concern. We will always have to contend with taxes and inflation. The best way to insulate yourself is to ensure that your future is not driven based on the federal balance sheet, but your own.

At Stonebridge, we emphasize the importance of minimizing the roadblocks to your success: taxes, fees, and inflation. The greatest dividend earned is independence by being financially unbreakable. We’re dedicated to your success by aligning your values with your wealth and empowering you to be a fearless investor in the face of any storm.