Time AND the Market

Have you ever thought about a time where you’ve made a decision and everything felt right about it, but the timing just ruined it. The importance of timing is probably no more evident than in baseball.

A 100-mph fastball takes about 0.40 seconds to reach home plate. For reference, a blink of an eye takes 0.30 seconds. The fastest baseball swings typically range from 0.10 to 0.15 seconds. A batter only has about 0.15 seconds to decide to swing. So, a fair ball, foul ball, home run, or strikeout ultimately comes down to about 0.007 seconds1.

While most of life’s decisions don’t come that close to the wire, there are plenty of historical instances of when time works against us. Here’s a short list:

- In 2021, a 57-year-old American drowned with a winning lottery ticket in his pocket2.

- Larry Silverstein, a commercial real estate investor, acquired a 99-year lease right for $3.2B to the World Trade Center on July 24, 20013.

- Farrah Fawcett, star of Charlie’s Angels, died on the same day as Michael Jackson in 2009. Not surprisingly it was a bit under the radar since everyone was busy listening to Thriller.

- September 16th, 2008, Smart Money (a Wall Street Journal publication) ran with this cover including the words: “Double your nest egg: Now’s the time to invest in cheap stocks, funds and real estate.” On September 17th, the stock market began a 30% collapse through the end of the year.

“It is time in the market that creates wealth, not market timing.” How many times have we all heard that said? There probably isn’t a person that I’ve worked with that I haven’t said these exact words to. Even though it continues to ring true to this day, the time you enter the market or your entry point can (and often does) play a role.

Market entry points can create either short term headwinds or tailwinds. But over longer periods of time, plays less and less of a role. Let’s consider the last major financial crisis.

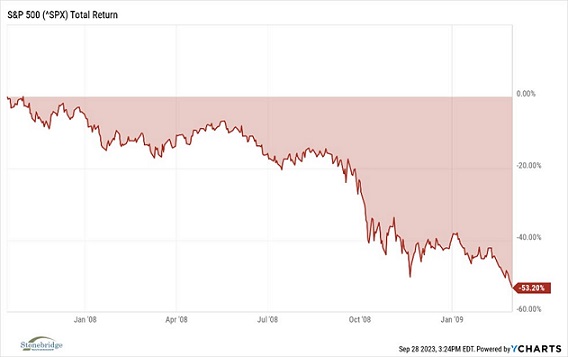

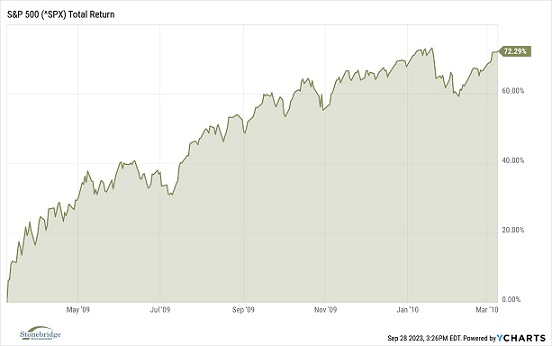

The S&P 500 lost half of its value from October 2007 to early March 2009. Do you know what happened just a week later?

The S&P gained over 72% over the next 12 months.

There are several historical instances of these types of major pivots. For those of you who started investing over the last 18 months, it probably feels more like the top chart than the bottom chart.

When planning a cross country road trip with multiple stops, the time you leave your house matters the first day, but considerably less and less over the course of the trip. So, what can you do when time works against you?

- Remain patient. Market volatility is a feature, not a bug. This too shall pass.

- Remain diligent and watchful for opportunities. Volatile markets present opportunities for those who can see through the noise and appreciate market cycles.

- Remind yourself that short term volatility is the price for long term wealth creation. Avoid measuring your cross-country round trip in inches. Measure it in miles.

To wrap things up, let me share some of Warren Buffett’s thoughts on time and investing.

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take your money, and go to Las Vegas.”

Or this gem:

“You can’t produce a baby in 1 month by getting nine women pregnant.”

The truth is that most things take time, and sometimes time isn’t working in your favor. The best we can do is to remain patient, capture opportunities, and be mindful that volatility is a short-term setback on a long journey of wealth creation.

Thank you for your continued trust and confidence in Stonebridge.

Tyler Martin, CFP®, CPWA®

1 Seattle Times

2 The Hill

3 Reuters