StonebridgeFOCUS - Still Climbing that Big, Beautiful Wall of Worry

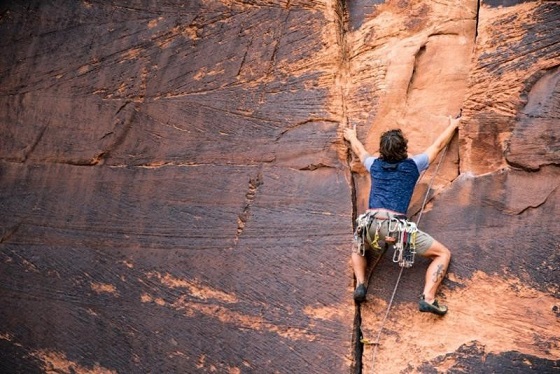

July marks the tenth anniversary of the U.S. economic expansion. The bull market in U.S. equities (as measured by the S&P 500 Index) reached its tenth birthday in March. The S&P 500 Index seemed to celebrate these achievements just a few weeks ago by moving into new-high territory—but there now seems to be more fear than cheer on Wall Street. What is the basis for the fear?

Recently, SEI Private Trust released its second-quarter Economic Outlook which we thought would be of interest. A summary of the conclusions is provided below:

- There is deep-seated anxiety that the bull market in equities is on its last legs, the victim of a slowing global economy, the lagged impact of last year’s interest-rate increases and, perhaps most importantly, a worsening trade war between the U.S. and China. There is no denying that the bull market in U.S. equities has been one for the record books, both in terms of magnitude and duration. From our perspective, we would need to see a severe deterioration in financial and leading economic indicators before climbing on the recession train.

- It is our view that the U.S. economy should be able to weather this storm. We believe there is still life in the economic expansion, both in the U.S. and globally. If we’re right, that means corporate profits should continue to expand and push global stock markets to higher levels in the months ahead. In all, we think the U.S. economy will demonstrate resiliency in the face of what is admittedly a stiff headwind.

- In May of this year, as stocks swooned and bond yields fell sharply, the yield gap widened dramatically in favor of equities. U.S. equities, in our opinion, still appear attractive, at least relative to bonds. In the absence of a recession or a complete meltdown of investor confidence, we believe that these yield spreads strongly support the case for maintaining exposure to equities versus bonds.

- The recent decline in bond yields to levels last seen in 2016 ranks as one of the biggest surprises of the year. The general expectation at the beginning of 2019 was for bond yields to drift higher; instead, the 10-year Treasury benchmark bond has plunged 70 basis points to 2%. We find it hard to justify these moves. In our view, recession is not likely in the absence of a severe policy mistake.

- The most recent (June) FOMC median projection of the Federal funds rate represents a dramatic change from the Committee’s December survey. Rather than policy rate increases, the dot-plot suggests there could be one rate cut by the end of this year, followed by another cut next year. However, the median forecast is highly misleading. Seven FOMC members think the Fed is likely to cut two times this year, while seven see no reason to change the funds rate from its current range of 2.25%-to-2.5%.

- It has been a long, lost decade for investors in European equities—at least when juxtaposed against the performance of the U.S. Europe currently faces a variety of idiosyncratic challenges, both economic and political, that makes it hard even for a contrarian investor to get terribly enthusiastic about the near term. Economically, there is no question that the region is going through another soft patch.

- And then there’s the looming cloud of Brexit. Although the Brexit date has been delayed until October 31 (Mr. Draghi must be relieved he won’t be around to deal with the issue), there is little sign that the breathing space will be put to good use. We can’t help but think Brexit will prove to be a highly disruptive event for the U.K. and the European Union, if it indeed occurs. Roughly half of the United Kingdom’s trade in goods, both imports and exports, is with the European Union.

To learn more about our distinctive goals-based approach to life and wealth management or request a copy of the full-length paper, please do not hesitate to contact our team directly.

We look forward to continuing to provide useful insights and relevant solutions focused on helping you achieve your greatest financial potential.

Thank you for your continued trust and confidence in Stonebridge.

All the best,

Mitch

About SEI Private Trust Company

Now in its 50th year of business, SEI (NASDAQ:SEIC) is a leading global provider of investment processing, investment management, and investment operations solutions that help corporations, financial institutions, financial advisors, and ultra-high-net-worth families create and manage wealth. As of Dec. 31, 2018, through its subsidiaries and partnerships in which the company has a significant interest, SEI manages, advises or administers $884 billion in hedge, private equity, mutual fund and pooled or separately managed assets, including $307 billion in assets under management and $573 billion in client assets under administration.