StonebridgeFOCUS - Apples and Interest Rates

“The U.S. economy isn’t likely to slip into recession anytime soon, and there is no reason for the Federal Reserve to cut interest rates,” former Fed Chair Janet Yellen said. Speaking to an investor conference in Fort Worth, Texas on Thursday, Yellen said that while Fed officials had marked down their economic growth forecasts to a median of 2.1 percent for 2019, “that’s not a recession. A slowdown is something that was long expected.”

The latest Federal Reserve (“Fed”) projections depicted a softer assessment of the economic outlook for 2019, and 2020 compared to its December report—with lower projections for overall economic growth and inflation, and higher projections for the unemployment rate.

Recently, SEI Private Trust Company published a Research Commentary entitled, “Is the Rate Hike Cycle Over?,” which we thought would be of interest.

Snapshot:

• The Federal Reserve’s latest projections depicted a softer assessment of the economic outlook.

• In a more concrete statement, the central bank said it plans to begin slowing its balance sheet reduction this May.

• Fed Chairman Jerome Powell confirmed that rate hikes will remain on hold until a consistent pattern or trend emerges.

Market observers and the media focused much of their attention on whether the Fed anticipated more increases in the funds rate over the next few years. The so-called dot plot revealed a more dovish outlook, with zero expected rate increases for 2019 (down from two in December) and one in 2020 (no change from December).

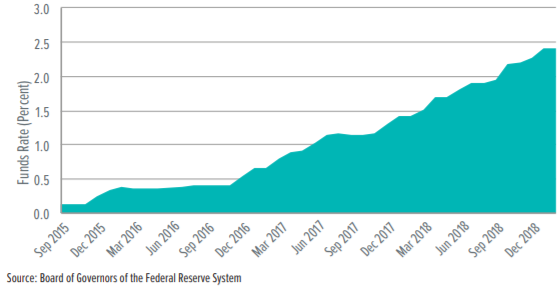

It’s fair to say that market pricing—which implied zero interest-rate increases in 2019 last year—was ahead of the Fed in calling for an end to the rate-hike cycle. Market probabilities now foresee a 33% chance that the funds rate will actually be cut by 25 basis points this year[1]. The chart below depicts the multi-year climb of the Fed funds rate, which began in earnest, at the end of 2016 and may have effectively concluded with the last hike in December 2018.

From Low to Plateau?

The New Normalization

Dot-plot projections for the Fed’s rate path may have dominated headlines following Wednesday’s announcement, but the most concrete development centered on the Fed’s balance-sheet normalization plans.

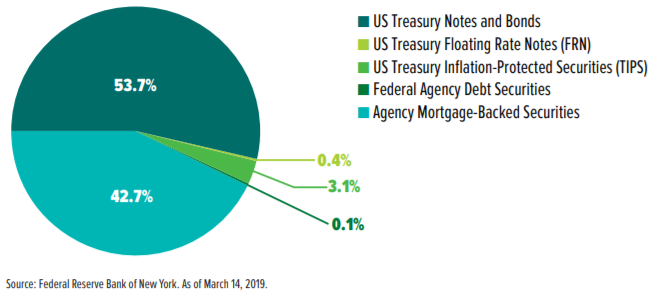

Starting this May, the roll-off cap—that is, the amount of securities that can mature without having their principal proceeds reinvested—will be reduced from $30 billion to $15 billion for the Fed’s holdings of U.S Treasurys. Roll-off is expected to conclude altogether for Treasurys at the end of September.

The central bank’s holdings of agency mortgage-backed securities (and, to a much lesser extent, agency debt) will continue to decline at a pace of $20 billion per month. In fact, starting in October, the Fed plans to begin re-investing up to $20 billion per month in principal proceeds into Treasurys. This will effectively tilt the Fed’s balance sheet away from mortgages and toward Treasurys over time.

The chart below provides a breakdown of the Fed’s balance sheet holdings.

Treasurys Set to Come Full Circle

Our Point of View

The Fed is unlikely to reverse course on the tapering of its balance-sheet normalization plan. On rates, however, Chairman Jerome Powell has continuously emphasized a patient, data-dependent approach. His statement yesterday confirmed that the central bank will remain on hold until a consistent pattern or trend emerges. He said, “the data are not currently sending a signal that we need to move in one direction or another.”

”Interest rates are to asset prices what gravity is to the apple. When there are low interest rates, there is a very low gravitational pull on asset prices.”

- Warren Buffet

To learn more about our distinctive goals-based approach to life and wealth management or request a copy of the full Research Commentary, please do not hesitate to contact our team directly.

We look forward to continuing to provide useful insights and relevant solutions focused on helping you achieve your greatest financial potential.

Thank you for your continued trust and confidence in Stonebridge.

All the best,

Mitch

[1] CME FedWatch Tool

About SEI Private Trust Company

Now in its 50th year of business, SEI (NASDAQ:SEIC) is a leading global provider of investment processing, investment management, and investment operations solutions that help corporations, financial institutions, financial advisors, and ultra-high-net-worth families create and manage wealth. As of Dec. 31, 2018, through its subsidiaries and partnerships in which the company has a significant interest, SEI manages, advises or administers $884 billion in hedge, private equity, mutual fund and pooled or separately managed assets, including $307 billion in assets under management and $573 billion in client assets under administration.