StonebridgeFOCUS – Conflicting Market Commentary: Where is the S&P 500 Going?

We’ve all seen headlines that seem to promise insight into financial market behavior. In reality, the stories that follow can range from informative analysis to inconsequential fluff.

Recently, SEI Private Trust Company published a Commentary, “The S&P 500 is Going to…,” which we thought would be of interest.

Snapshot:

- Sometimes, particularly amid rising economic uncertainty and market volatility, the financial news media publishes stunningly conflicting market analysis.

- One headline news story says that the S&P 500 is going to go up. The next story says that it’s going to fall.

- In times like these, we believe the most important thing to do is focus on personal career, life and wealth goals.

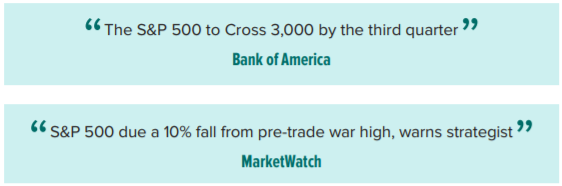

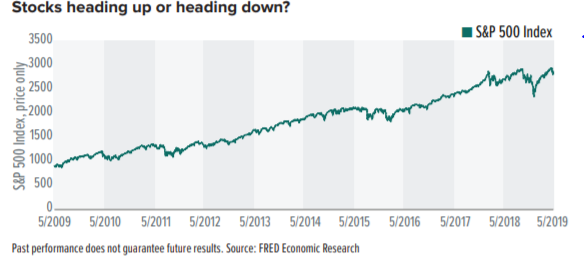

When taken collectively, headlines may provide a relatively consistent big-picture view of the market. But every once in a while, particularly amid rising economic uncertainty and market volatility, we come across stunningly conflicting market analysis, sometimes on the same day within the same media outlet. For example, the following headlines recently have appeared right next to each other on a popular stock-market tracking app:

The two articles were almost comical in their contradictory nature. The first predicted a rise in equity prices as strong market performance encourages investors to buy more stock. The second forecasted a drop in stock prices if the U.S. and China fail to secure a trade deal.

Whats an investor to think?

Mixed messages like these cause confusion among investors as they try to make sense of the details, cultivate their own big-picture market view and use that information to make decisions about 401(k) plans, personal brokerage accounts, corporate pension plans, and endowment and foundation assets. Professional investors face the same decisions and rely on an even greater variety of data points and information sources in an attempt to make sound decisions. They also encounter contradictory messages, as demonstrated by recent debates about whether interest rates are going to rise or fall.

Our point of view

When faced with confusing market signals, we think the most important thing to do is to remind yourself of what you want to achieve with your career earnings —and consider whether your current approach supports those life and wealth goals.

We call this goals-based wealth management. This requires identifying exactly what you want your money to do (for example, fund current lifetsyle needs, parental and family support, career transition, retirement, philanthropy, dynastic, or achieve any combination of such objectives) and then (and only then) developing a financial strategy accordingly. It’s an investment approach that has little to do with what’s happening in day-to-day news and everything to do with the big-picture view of how you desire to live your life.

“Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.”

Warren Buffett

To learn more about our distinctive goals-based approach to life and wealth management or request a copy of the full-length monthly commentary paper, please do not hesitate to contact our team directly.

We look forward to continuing to provide useful insights and relevant solutions focused on helping you achieve your greatest financial potential.

Thank you for your continued trust and confidence in Stonebridge.

All the best,

Mitch

About SEI Private Trust Company

Now in its 50th year of business, SEI (NASDAQ:SEIC) is a leading global provider of investment processing, investment management, and investment operations solutions that help corporations, financial institutions, financial advisors, and ultra-high-net-worth families create and manage wealth. As of Dec. 31, 2018, through its subsidiaries and partnerships in which the company has a significant interest, SEI manages, advises or administers $884 billion in hedge, private equity, mutual fund and pooled or separately managed assets, including $307 billion in assets under management and $573 billion in client assets under administration.