StonebridgeFOCUS | Good Numbers and Bad Numbers

I am a sucker for a good statistic. Sports, economic, financial, it doesn’t matter. I love ‘em all. But my favorite statistics are those that get overshadowed and overlooked. For example:

- Larry Fitzgerald played 17 seasons as an NFL wide receiver for the Arizona Cardinals. Larry Fitzgerald has more career tackles than dropped catches.[1] For those that may not know, a wide receiver plays offense.

- If you divided the US national debt by the number of citizens, each would be responsible for nearly $100,000 in debt[2]. The median household income in the US (as of 2020) is only $67,521.[3]

- Wayne Gretzky, regarded as the greatest NHL player in history, holds the NHL record with 2,857 career points. He is so far ahead of the second-place finisher (Jaromír Jágr) that if you omitted his goals scored, he would still be the all-time point leader.[4]

- In 1986, The Economist created the Big Mac Index, which tracks the prices of the eponymous sandwich across different countries, ultimately measuring how exchange rate variations.[5] To be clear, a hamburger is being used to measure how currencies are valued in relation to one another.

- Tom Brady, statistically speaking, has a greater chance of making the Super Bowl (47.6%) than Steph Curry has of making a 3 pointer (43.3%).[6]

- US GDP (standard measure of the value added created through the production of goods and services in a country) is nearly $21T, which is nearly 50% higher than the second largest, China.[7]

- In two different seasons (1920 and 1927), Babe Ruth hit more home runs than any other team.[8]

- The first social security check was issued in 1940 to a woman at age 65.[9] Did you know the average life expectancy in 1940 was 60? 82 years later, the full retirement age for social security increased a whopping two years while life expectancy has increased nearly twenty years.[10]

- Wilt Chamberlain, best known for his 100-point game, has even more jaw dropping stats. For example, he scored 50-points or more in 118 games, which is 87 more than the second-place finisher, Michael Jordan.[11] Wilt is the GOAT of wild statistics.

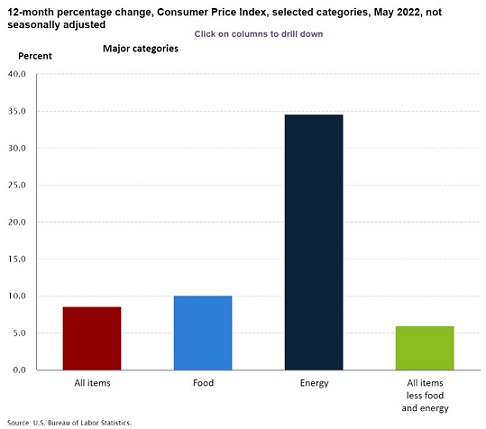

- US inflation (year-over-year) hit 8.6% in May, which is the highest measure since 1981, which means if you are a Millennial or younger generation, this is uncharted territory for you.[12]

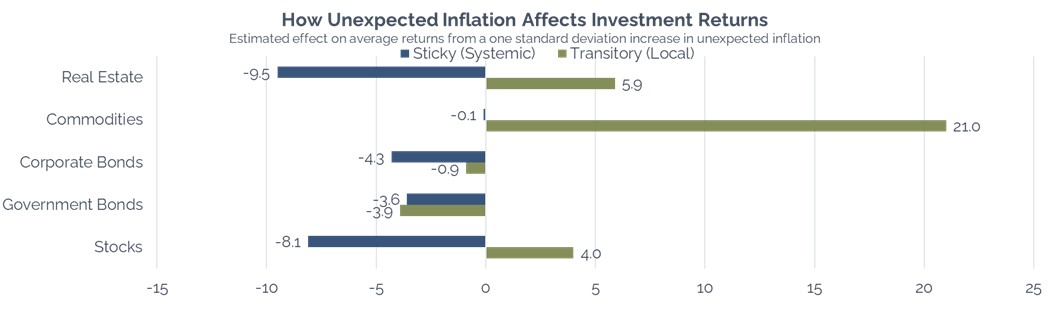

Some numbers matter, some don’t. Wilt Chamberlain’s number of 50-point games doesn’t have any influence on our daily lives. But persistent inflation is certainly a troubling trend and one that most haven’t encountered meaningfully for decades, if ever. Food and energy are certainly pouring gasoline on the inflation fire, but inflationary pressures are starting to pop up in services and other parts of the economy, as well. The question that is on most investors minds is what does this mean?

By itself, not a lot, other than things get more expensive. What matters is the context or how the economy responds to higher inflation, meaning does the economy continue to contract, or resume a growth trend.

If the US economy continues to contract, this will confirm that we are entering into a stagflation environment, which is when inflation runs high, and growth (measured by GDP) is declining.

If the US economy starts to grow, this will mean we are shifting to a reflation environment, which is when inflation runs high, and growth is rising.

Of the two, reflation is certainly what economists are hoping for, but only time will tell.

It’s important to note that at Stonebridge, we build client portfolios with this in mind. Whether we see stagflation, reflation, stagnation, or any other kind of “ation”, we have designed client portfolios to navigate this season and protect the assets of those we serve.

If you’d like to see more of our insights on inflation, see our recent contributions to Fortune and InvestmentNews.

Thank you for your continued trust and confidence in Stonebridge.

Tyler Martin, CFP®, CPWA®

[1] Pro Football Reference

[2] US Debt Clock

[3] US Census

[4] QuantHockey

[5] The Economist

[6] Sportscasting

[7] The World Bank

[8] Bleacher Report

[9] Social Security Administration

[10] Berkeley

[11] Basketball Reference

[12] The Wall Street Journal